FIGURES AND STATISTICS

Coverage of various third-party market reports and our findings

STATS

Logistics Facility Vacancy Rate in Greater Tokyo Area Drops

STATS

Real estate industry loans remain strong, outstanding loans exceed Y140tn

STATS

20% of Companies Hold Idle Real Estate

STATS

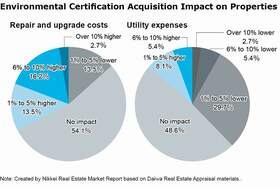

Environmental Certification Costs

STATS

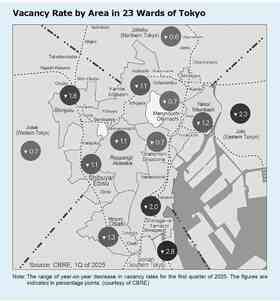

Office Demand Flows Outside

STATS

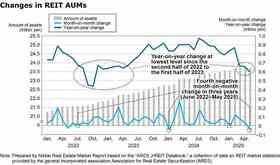

REIT AUMs Decrease in May

STATS

Record High Hotel Investment Market

STATS

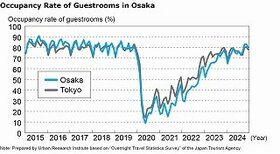

Osaka Market Remains Strong

STATS

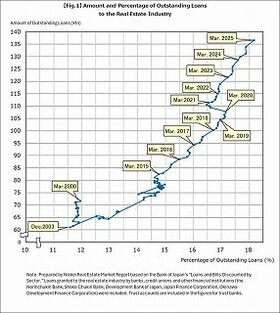

Real estate industry loans reach Y136tn, exceeding 18% overall

STATS

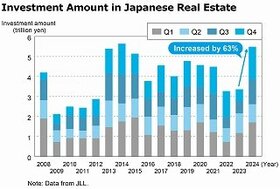

Investment Recovering Rapidly

STATS

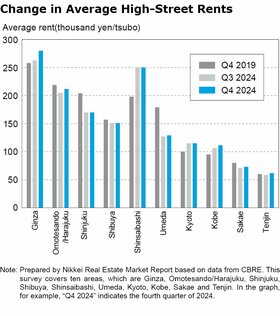

Urban Retail Facility Rents Rise Significantly

STATS

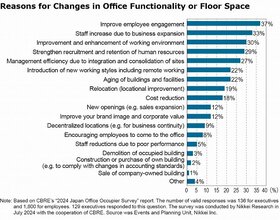

Improving Employee Engagement Drives Office Demand

STATS

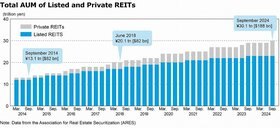

J-REIT AUM Exceeds 30 Trillion Yen

STATS

Record High Transaction Volume

STATS

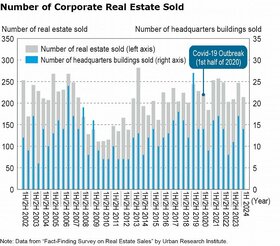

Head Office Building Sales Increasing Again

STATS

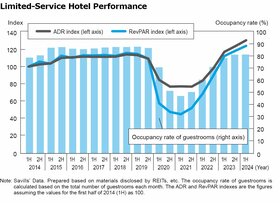

Hotel Market Remains Strong

STATS

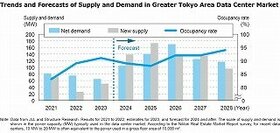

Growing Data Center Market

STATS