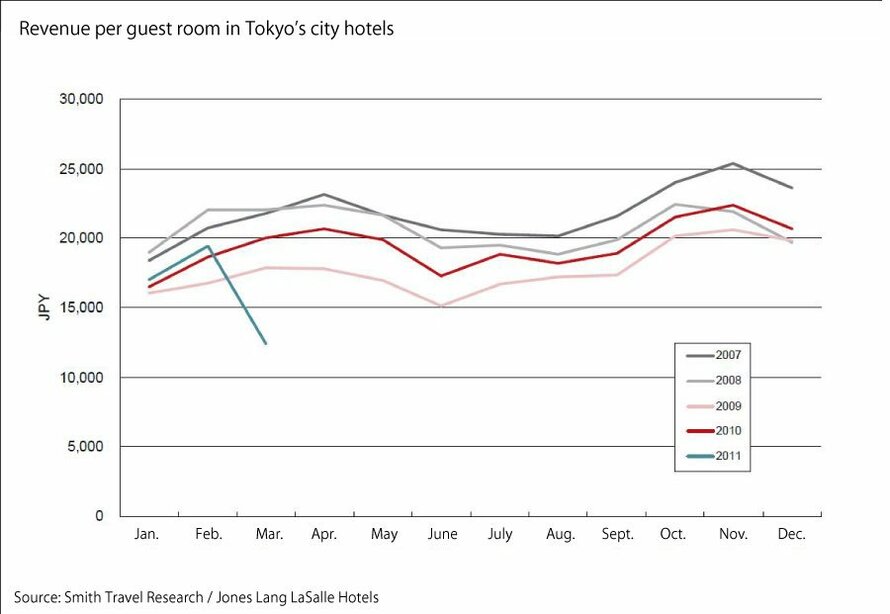

Due to the impact of the earthquake and the Fukushima nuclear power plant incidents, the number of foreign visitors to Japan from March 12, the day after the earthquake, to the end of the month was a decrease of 73% year-on-year. Domestic demand also dropped and revenue per guest room (RevPAR) of Tokyo’s city hotels for March fell 38% year-on-year (see graph). RevPAR of Osaka’s city hotels for the same period, on the other hand, has risen 13% year-on-year due to office relocations from eastern Japan as well as shifting leisure demands.

As for the outlook of the hotel operation market, the pace of recovery of each hotel will differ according to their targeted customers, sales ratio, etc. Although demand from domestic companies is rapidly recovering, domestic leisure is still on its way to recovery. A recovery scenario of foreign tourists is yet to be seen. However, JLLH predicts that the overall market will recover in about one to two years, with the premise that the nuclear power plant issues move towards being solved as scheduled.

As for the hotel investment market, JLLH indicated their view that though cash flow will decline due to drops in sales, there will be no major fluctuations in cap rates. There is also the possibility that, due to the decline in sales, operators will ask real estate owners and financial institutions to reduce rents and review debt repayment schedules. JLLH predicts that financial institutions will wait and see for the time being as they anticipate a cash flow recovery in the medium term, and points out that so called fire sales are unlikely to happen.