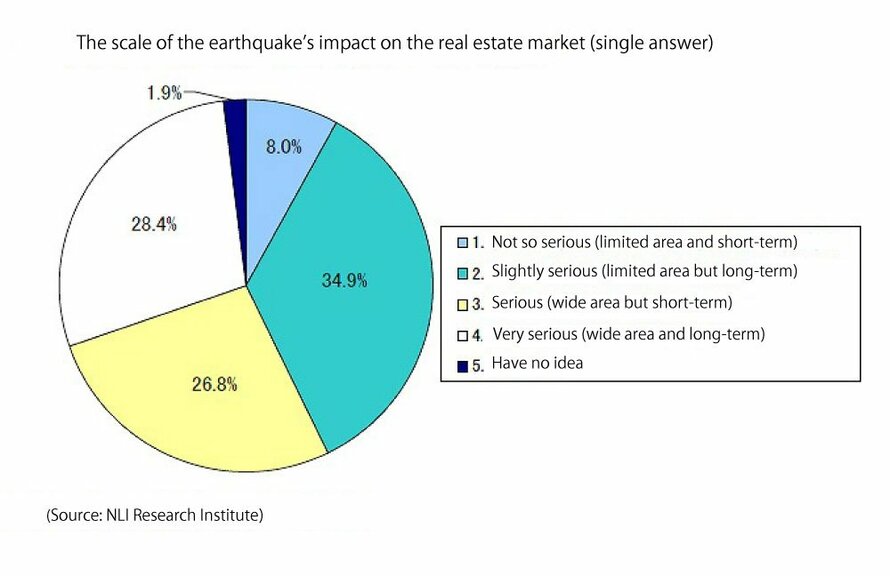

A total of 34.9% of all respondents picked “slightly serious” (limited area but long-term) as the most common response, while 26.8% chose “serious” (wide area but short-term) and 28.4% selected “very serious” (wide area and long-term). Respondents considering the impact to be “not so serious” (limited area and short-term) only accounted for 8.0% of the total.

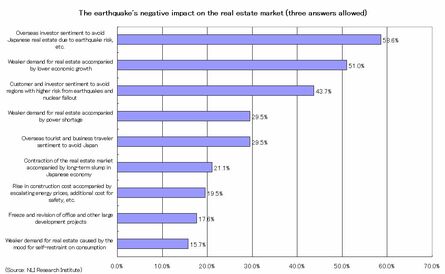

The survey also contained a multiple choice question regarding the quake’s negative impacts on the Japanese real estate market (home sales, rental and investment markets). As a result, the most common response was “overseas investor sentiment to avoid Japanese real estate due to earthquake disaster risk and nuclear power plant risk” chosen by 58.6% of respondents, followed by “weaker demand for real estate accompanied by lower economic growth” chosen by 51.0%.

As for risks that will receive greater focus in the wake of the Great East Japan Earthquake, responses were ranked “overconcentration in Tokyo” (56.3%), followed by “earthquake disaster and tsunami” (50.6%) and “power shortage and blackout” (37.5%).

Asked what types of real estate are expected to face stricter screening of customers and users or weaker needs, the rate of respondents who chose “condominiums,” “office buildings” and “hotels” exceeded 40%.

In the open answer section, opinions such as “we are discussing whether or not it is safe to construct a data center in Tokyo,” “as cash flow rapidly worsened at hotels in Tokyo, we cannot make any forecasts until the nuclear power plant is declared safe,” “larger rent reductions are being requested for commercial facilities than in other sectors” and “we are concerned that interest rates might rise over the mid- to long-term to generate funding for disaster relief” were provided.

The survey results generally reflect strong concerns about the nuclear power plant accident and power shortage, but the open answer section some respondents stated, “Self-restraint on consumption affects commercial facilities, but the impact on the overall real estate market will remain nominal,” and “We are shifting from a time when efficiency and comfort were pursued by consuming energy to a time when energy conservation is deemed as added value.”